Basic Views on Corporate Governance for the Group

Based on our Group mission to sensitize the world to beauty, the POLA ORBIS Group offers a number of brands each with differing properties. We deploy our businesses based on the recognition that our strengths are in our high brand loyalty through direct ties with customers, R&D capabilities in the skincare area through concentration of our resources, and multi-value chain strategy exploiting strong synergistic effects of our brands upon each other. Each operating company under the Group umbrella essentially manages itself autonomously and independently, while POLA ORBIS HOLDINGS, as the holding company, retains management control over each operating company and strives to increase corporate value through ensuring sound management and improved efficiency in Group operations overall.

The POLA ORBIS Group also incorporates compliance into CSR activities, emphasizing compliance as an integral part of business. The POLA ORBIS Group strives to realize sustainable development of the Group through initiatives where the Group, as a good corporate citizen, works to deepen cooperation and establish trustful relationships with various stakeholders, including shareholders and business partners, and fulfills its corporate responsibilities. In addition, the Company has established the POLA ORBIS Group Code of Conduct to cover the various facets of responsible corporate activity, including legal compliance, environmental protection, and shareholder relations, and all executives and other employees pledge to abide by the Code of Conduct.

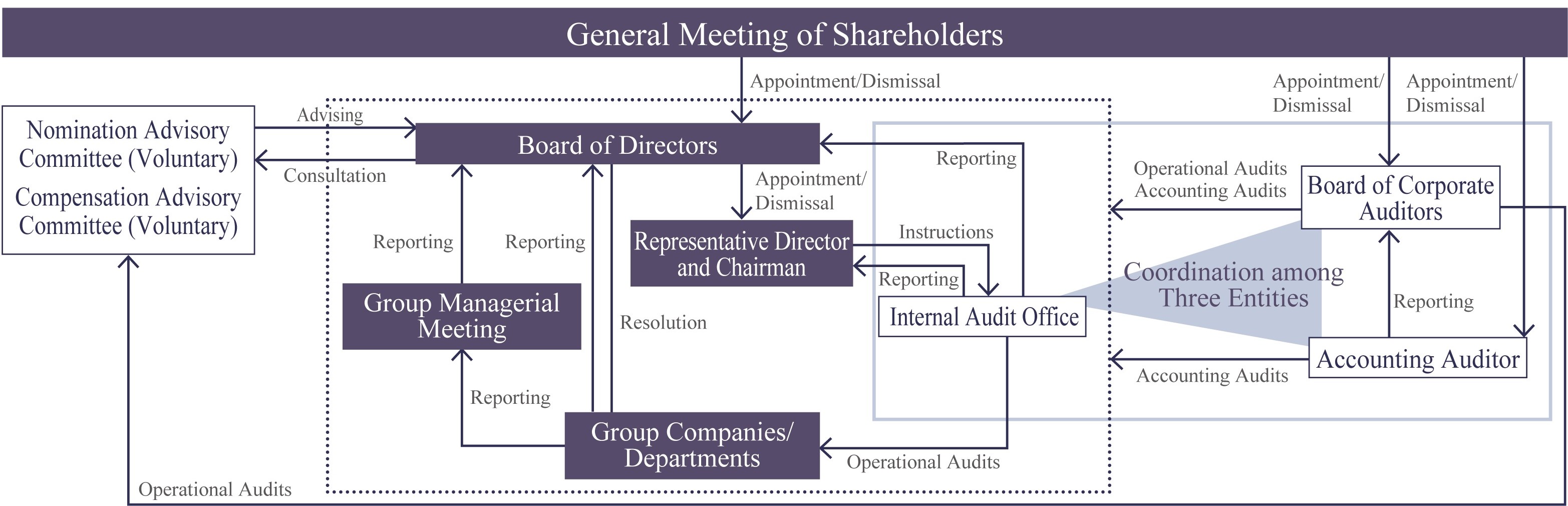

Corporate Governance Structure

| Purpose and Activities | Members | Meeting Schedule | |

|---|---|---|---|

1. Board of Directors | The Board bears responsibility for achievement of Group business performance and is authorized to supervise subsidiaries and make decisions for the Group on important matters. The Board of Directors meets monthly to make resolutions and reports regarding important matters related to management, such as results of analysis of differences between budgeted and actual figures for the month, in addition to matters as prescribed in laws, regulations, and the Articles of Association. | 10 directors (5 of whom are independent outside directors) | At least once a month. In 2024, directors met 19 times. |

2. Board of Corporate Auditors | Each corporate auditor attends important meetings, such as Group managerial meetings, as well as the General Meetings of Shareholders and Board of Directors meetings, as well as receiving reports from directors, employees, and the accounting auditor, among other activities involved in its supervision of the business execution of directors. | 4 corporate auditors (3 of whom are outside corporate auditors) | At least once a month. In 2024, meetings were held 17 times. |

3. Group Managerial Meeting | Deliberates and receives reports on important matters related to the Company and subsidiaries. | Company directors and the full-time corporate auditor as well as subsidiary presidents, directors, and others chosen for membership through resolutions of the Company Board of Directors | - |

4. Nomination Advisory Committee (voluntary) | The Committee’s role is to ensure the objectivity, transparency, and effectiveness of the decision-making process regarding personnel affairs important from a management perspective by deliberating and reporting on matters such as the nomination of Company director candidates, appointment of Corporate Officers, and nomination of director candidates at subsidiaries, etc., based on requests from the Board of Directors. | Outside directors make up the majority of the committee members. The committee chair is an outside director appointed by the Board of Directors. | In 2024, meetings were held 4 times. |

5. Compensation Advisory Committee (voluntary) | The Committee’s role is to ensure the objectivity, transparency, and effectiveness of the decision-making process by deliberating and reporting on matters such as the system design of the compensation program for Company executives, compensation for Company directors, and compensation, etc. for Directors and Corporate Officers at subsidiaries, etc. of the Company, based on requests from the Board of Directors. | Outside directors make up the majority of the committee members. The committee chair is an outside director appointed by the Board of Directors. | In 2024, meetings were held 8 times. |

The Company considers it important that the board consist of members who possess wide-ranging perspectives and a wealth of experience and specialized knowledge, as well as being able to reflect these properties in Company management through flexible thinking, and that their knowledge, experience, abilities, and other attributes are maintained in a healthy balance.

A skills matrix is prepared covering such matters as the knowledge, experience, and competencies of each director and corporate auditor. Readers are encouraged to view the skills matrix below.

Please refer to our convocation notice of the annual shareholders’ meeting for the reasons for appointment as directors.

-

Corporate Governance Report

(842KB)

Corporate Governance Report

(842KB)

-

Basic Policy on Corporate Governance

(122KB)

Basic Policy on Corporate Governance

(122KB)

The Board of Directors makes decisions on the remuneration for Company Directors and Executive Officers based on deliberations and reporting by the Compensation Advisory Committee taking into consideration individual positions and contributions to business performance.

In its 13th Regular General Meeting of Shareholders held on March 26, 2019, the Company resolved to adopt a share-based remuneration program linked to medium- to long-term performance (hereinafter "Program") to replace the existing stock-option program. Policies and procedures for decisions on remuneration of directors in the POLA ORBIS Group following the adoption of this Program are outlined below.

1. Basic views

The POLA ORBIS Group considers executive remuneration to be an important means of realizing the sustained growth of the Group and increases in corporate value over the medium to long term. As the Group holding company, the Company makes clear the roles and responsibilities in execution of individual responsibilities for the Company directors and other executives, whose main duties are to make decisions on Group management as a whole and to supervise business execution, and the directors of subsidiaries to which the Company delegates business execution authority. Executive remuneration is based on the responsibility for business performance and other results in relevant areas of business execution and serves as strong motivation for the achievement of results over not only the short term but the medium and long terms as well. In addition, executive remuneration is oriented toward further sharing of gains with shareholders by making clear its linkage to share prices.

2. Remuneration levels

Remuneration levels are set in light of the scale of individual roles and responsibilities, through consideration of the POLA ORBIS Group's business conditions and competitive strengths in external markets, and comparison with firms in the same industries or of the same size both in Japan and around the world.

3. Remuneration structure

The POLA ORBIS Group's executive remuneration (excluding outside directors) consists of a fixed basic component and variable annual bonuses and a performance-linked share-based component. Annual bonuses include additional mission payments for officers responsible for specific missions, in addition to remuneration paid in accordance with the achievement of business performance targets.

Remuneration for outside directors consists of a fixed basic component and a non-performance-linked share-based component. Remuneration for corporate auditors consists only of a fixed basic component.

The share of executive remuneration accounted for by variable remuneration is set within the range 40% to 65% depending on the job grade category and mission of the individual executive. The variable remuneration of annual bonuses varies within the range of 0% to 200% depending on such factors as the Group's achievement of business performance targets and each individual's achievement of mission KPIs for the fiscal year, while that of the performance-linked share-based component varies within the range of 0% to 200% depending on such factors as the POLA ORBIS Group's achievement of business performance targets in the medium-term management plan and other targets.

4. Executive remuneration decision-making process

To ensure objectivity and transparency in the executive remuneration decision-making process, the Company has established a Compensation Advisory Committee wherein the majority of the membership consists of outside directors to serve as a voluntary advisory body to the Board of Directors. Decisions on the POLA ORBIS Group's executive remuneration are made by the Board of Directors within the scope of the remuneration limits approved at the General Meeting of Shareholders based on deliberations and reporting by the Compensation Advisory Committee.

Total, including compensation by executive classification, and total by type of compensation (Fiscal 2024)

|

|

unit: mil. yen